離職や解雇、やむを得ない休業等で生活に困窮する方へ

Guidance on Temporary Loan Emergency Funds

Guidance on Temporary Loan Emergency Funds

Guidance on Temporary Loan Emergency Funds

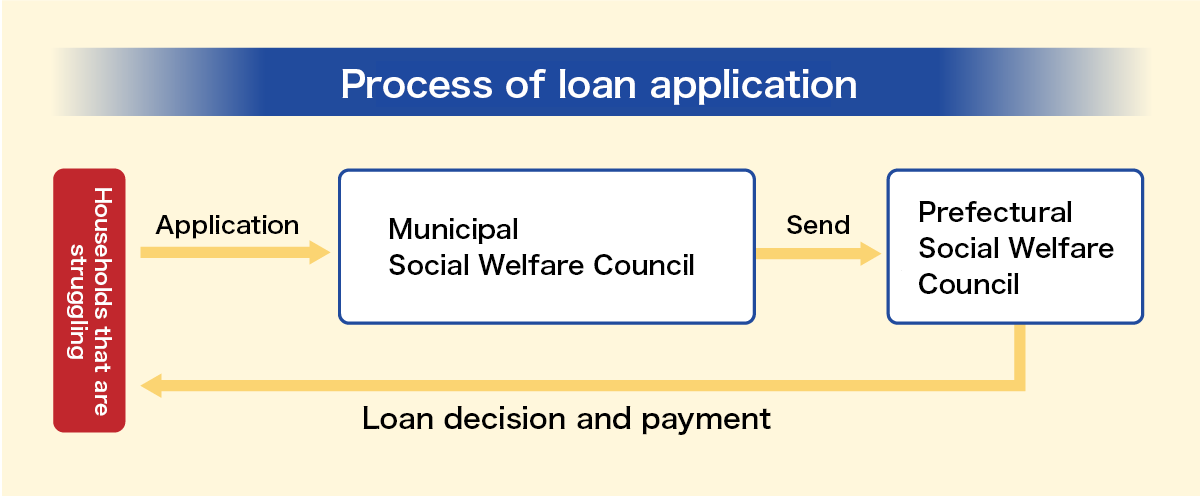

The Social Welfare Councils of all prefectures are providing a welfare fund loan system to lend necessary funds for living and other expenses to low-income households.

In light of the impact of the COVID-19 pandemic, the number of households that are eligible for loans under this system will be expanded to include non-low-income households. Special loans such as emergency small amount funds will be provided to households that are struggling for their living expenses as a result of temporary stoppage of work or unemployment.

Please see overleaf for detailed information about these special loans. Please use the contact information provided below for questions about specific contents.

Mainly for households that are

facing temporary stoppage of

work

(emergency small amount fund)

Applicable households

Households facing a decrease in income due to temporary stoppage of work, etc. as a result of COVID19, and who require an urgent temporary loan to maintain their livelihood* This is an expansion of the previous limitation to low-income households.

* A household is eligible if its income has decreased because of COVID-19, even if the working persons’ work has not temporarily stopped.

Loan amount upper limit

- Temporary stoppage of work at school, etc. or special loans for sole proprietors, etc.: ¥200,000

- Other cases: ¥100,000

* This is an expansion of the previous upper limit of ¥100,000.

Deferment period

Within 1 year* This is an expansion of the previous period of 2 months

Repayment deadline

Within 2 years* This is an expansion of the previous period of 12 months.

Loan interest/Guarantor

0%/Not requiredApply to:

Mainly for households who have become unemployed

(general support funds)*

* Living support expenses from within general support funds

Eligible households

Households affected by COVID-19 pandemic that are suffering financially because of reduced income or unemployment, making it difficult to maintain their daily life* This is an expansion of the previous limitation to low-income households

* A household is eligible if its income has decreased because of COVID-19 pandemic, even if the working members have not lost their employment.

Loan amount upper limit

- (Two or more persons) ¥200,000/month

-

(Single person) ¥150,000/month

Loan period: Within 3 months in principle

Deferment period

Within 1 year* This is an expansion of the previous period of 6 months.

Repayment deadline

Within 10 yearsLoan interest/Guarantor

0%/Not required* Relaxation of conditions. Previously, a guarantor was required for 0% interest, or 1.5%/year interest was charged when there was no guarantor

Apply to:

Note: In principle, the household must receive continuous support in the form of self-reliant consultation support services.

As a new condition, under these special measures, households that are exempt from municipal tax and whose income continues to be reduced can be exempt from repayment.